What are the different banks in Switzerland and how to choose one?

Reading time 8 min. Updated on May, 17th 2024.

The line-up:

What type of banks are there?

Moving to a new country or starting a new career is a big deal. And in this whirlwind of new things, choosing your bank is a key step. It may seem trivial at first, but make no mistake, it’s anything but. You see, a bank isn’t just the box where your salary lands each month. It’s also your partner in making your savings grow, perhaps helping you to get the keys to your future home, and offering you sound advice to boot. But all this has a cost, doesn’t it? So what are the good deals and the pitfalls to avoid among the banking options in Switzerland? That’s what we’re going to try to unravel.

In short, there are three types of bank in Switzerland: international, regional and mobile. Many people are unfamiliar with the latter, even though it offers significant advantages.

What is a bank (international or systemic)?

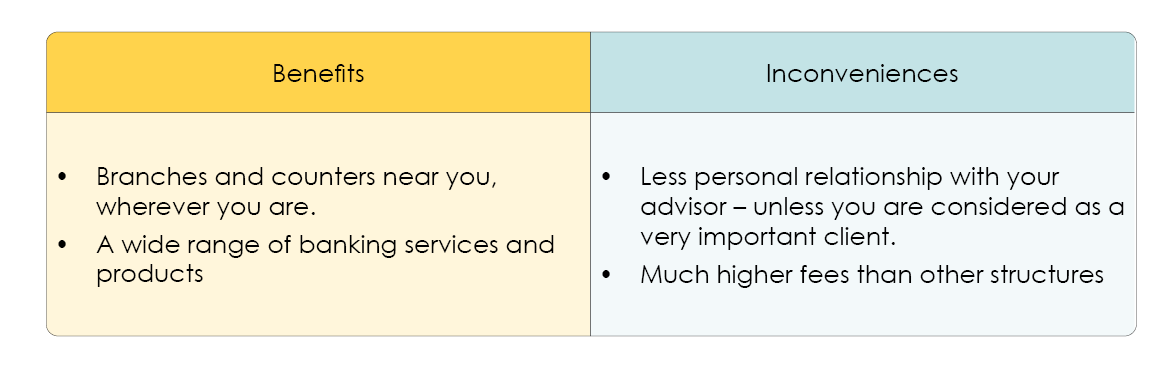

I was going to say we all know banks like UBS, Crédit Suisse, etc. But that was before. Today, it would be better to say that everyone knows UBS. Yes, since UBS took over (or went bankrupt), there really isn’t much choice left in Switzerland if you want to go to a big bank (not a cantonal or regional one).

There aren’t many of them left, but among the systemic banks (so important that if they were to go bankrupt it would do great damage to Switzerland) we can still mention :

- PostFinance

- Zurich Cantonal Bank

- Raiffeisen Cooperative Bank

They concentrate a large part of countries the wealth. Clients often feel reassured by the prestige of a big bank.

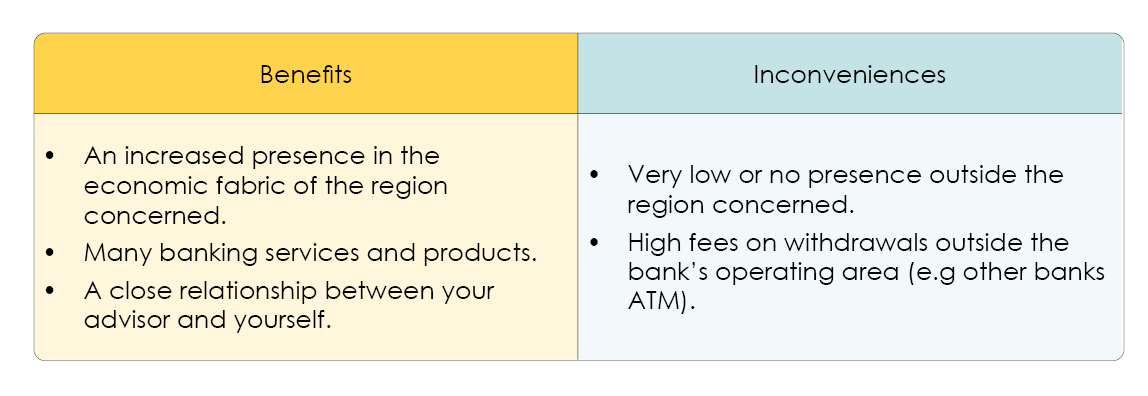

What is a regional bank?

Some of the regional banks are less well known, especially if you are new to Switzerland. And for good reason: they play at home, mainly in their home canton. That’s where they shine, even if finding one of their ATMs (or cash dispensers, for those uninitiated to the Swiss way of life) outside their territory is a bit of a mission impossible. Would you like to finance a property purchase at the other end of the country, or even abroad? Hold on tight, because they’re not really fans of far-flung adventures. But, and this is a big but, these banks do have their charms. They know their customers’ needs inside out, offer unfailing flexibility and make a point of winking at you. In short, they have that little personal touch that can really make all the difference.

These banks include the official cantonal banks:

- Banque Cantonale Vaudoise (BCV)

- Geneva Cantonal Bank (BCGE)

- Valais Cantonal Bank (BCVS)

And other establishments :

- WIR Bank

- Migros Bank

- Valiant Bank

The regional bank in one sentence: a bank that listens to your aspirations, and supports you achieving your goals.

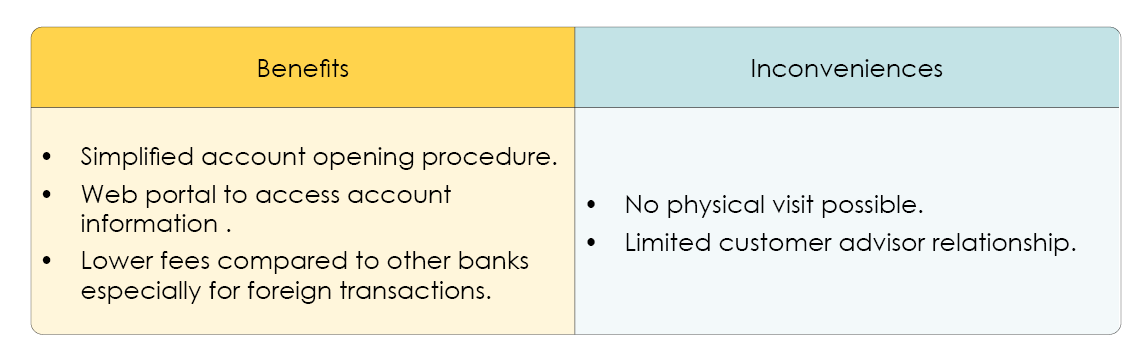

What is a mobile bank?

It’s immediately harder to name them, right? They go by the name of ZAK, Revolut or Neon. That said, the number of customers is exploding and for very good reasons.

They have no building or physical advisor. Everything happens digitally : on their website or through a mobile application.

Although it may initially seem confusing at first, such an operational model allows for cost reduction directly reflected in savings for customers (account management, etc).

They are also called FinTech or neo-banks.

Mobile banking in a nutshell: your finances at your fingertips.

But how do I find out which option suits me best ? This is a matter of meeting an offer (the bank) and the demand (yours). That’s why you should be clear about your expectations of a bank.

But enough of the blah, let’s take an example: mine. If I had to choose a type of bank, what should I consider ?

How to choose the bank best suited to your situation?

Now that we’ve explored the different types of bank available, it’s time to look at how to choose from among the many options.

Your location

Let’s say that I live in the municipality of Chalet-à-Gobet and work in the centre of Lausanne. Thus, I have bank offices within close proximity to me.

But if I lived in Bioley-Magnoux and worked in the neighbouring municipality of Donneloye, I would be making sure that I could find an office in at least one of those villages.

We took this example because in Switzerland, if you have the misfortune to withdraw money from a bank that is not your own, beware of the charges, which can quickly become substantial unless you pay a monthly fee, which is not much nicer.

In conclusion, if you need to withdraw money regularly, check that you have access to an ATM belonging to your bank or that your bank does not charge fees for withdrawals from its competitors. On the other hand, if all your transactions are made via your phone (apple pay, TWINT or other applications), proximity to your bank becomes secondary.

That being said, I would of course not necessarily be signing up at the Cantonal Bank of Fribourg.

Your projects, needs and the quality of the service

Proximity is convenient, but it’s not everything… The variations between banks’ offers and products play a crucial role in your decision. Now let’s imagine that you have big ambitions, such as :

- Starting your own business

- Buying a property

- Putting your money into specific investments

- Minimising annual fees

- Making international payments

- And many other projects…

In this case, it may be a good idea to review your priorities in terms of distance. Opting for a bank that’s a little further away, but better suited to your needs and plans, could save you both time and money. Finding a bank that really resonates with your situation may mean making some compromises on proximity, but aligning their services with your goals is often worth the effort.

Your age and familiy situation

Some banks specifically target well-defined customer segments, such as :

- Students

- families

- Young professionals

- Working people

- Company directors

- And many others…

To attract these specific groups, banks make considerable efforts and offer particularly competitive financial packages, often limited in time or conditional on age. For example, some banks offer unmarried couples benefits such as no charges for managing their joint account, provided they maintain a minimum amount. They may also offer advantageous credit cards, make it easier to open additional accounts, or offer more favourable terms for mortgage rates and loans. “Neon? Raiffeisen? Credit Suisse ? UBS ? Flowbank ? Cantonal bank?” There are many different banks and your choice will depend on your situation.

Have you made up your mind? One last quick article to explain to you the different types of accounts and you will be a KING when it comes to banks.

How FBKConseils can help you choose your bank?

When it comes to selecting your banking institution, FBKConseils adopts the position of impartial adviser rather than broker. We only partner with Swiss or international banks when we identify exceptional players, recognised for their investment expertise or established reputation. Our role is to support you in the choice process, providing you with the advice you need to avoid pitfalls and guiding you towards the solutions best suited to your needs and expectations.

Discover our new online platform to entrust us with your tax return!

Complete your 2023 tax return online!

In the blink of an eye!